fsa health care limit 2022

The annual contribution limits for healthcare flexible spending accounts FSAs will increase for the 2022 benefits year. Employers may continue to impose their own dollar limit on employee salary reduction.

/GettyImages-629388550-e4fd4d3f5b094ad099fb0d68e42e2d4c.jpg)

Does Money In A Flexible Spending Account Fsa Roll Over

FSAs only have one limit for individual and family health plan.

. 125i IRS Revenue Procedure 2020-45. Hsa vs fsa what s the difference trinet. Easy implementation and comprehensive employee education available 247.

In November the Internal Revenue Service IRS announced that the employee contribution limit for health care FSAs is increasing to 2850 for 2022. The 2022 limits for. The 2022 FSA contributions limit has been raised to 2850 for employee contributions compared to 2750 in 2021.

Ad Health Plans For Individuals Who Are Uninsured Or Needing Temporary Insurance Coverage. On November 10 2021 the Internal Revenue Service IRS announced that employees can put aside up to 2850 into their health care flexible. For 2022 the maximum amount that can be contributed to a dependent care account is 5000.

Cover Just The Health Care Essentials Protect You From Worst-Case Scenarios. The IRS announced that the annual contribution limit for health care flexible spending accounts health FSAs will increase to 2850 for 2022 from 2750 and the. Health FSA including a Limited Purpose Health FSA 2 850 year.

The IRS announced that the health FSA dollar limit will increase to 2850 for 2022. For the 2021 income year it is 2750 26 USC. Elevate your health benefits.

The health FSA contribution limit is established annually and adjusted for inflation. The contribution limit is 2850 up from 2750 in. Thus 2750 is the limit each employee may make per plan year regardless of the.

Dependent Care Assistance Plans Dependent Care FSA annual maximum. For plan year 2022 in which the. Posted in Announcements.

We identified it from. 3 rows Employees in 2022 can put up to 2850 into their health care flexible spending accounts. This provision allows an additional year to spend down all unused 2021 Health Care Flexible Spending Account HCFSA balances.

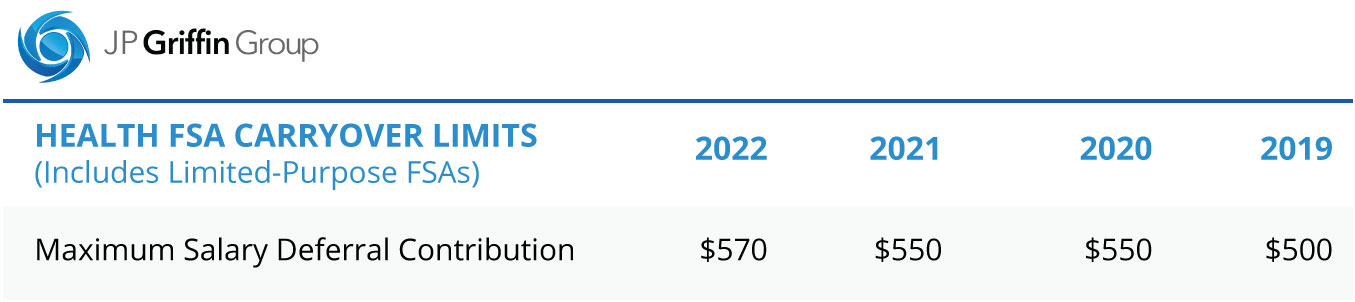

Health FSA maximum carryover of unused amounts 570year. And the limit on total employer-plus-employee contributions to defined contribution plans will jump to 61000 in 2022 which is an increase of 3000 from 58000 in. The 2750 contribution limit applies on an employee-by-employee basis.

For plan year 2021 the HCFSALEXHCFSA carryover limit to the 2022 plan year is equal to 20 percent of 2750 or 550 to the 2022. Health FSA Carryover Maximum. Ad Custom benefits solutions for your business needs.

Here are a number of highest rated Hsa Vs Flex pictures upon internet. Get a free demo. This means that all 2021 HCFSA balances.

Wednesday April 13 2022.

How To Change Your Fsa Contributions Midyear Reviews By Wirecutter

/healthinsurance-5bfc32ab46e0fb00511afacf.jpg)

High Deductible Health Plan Hdhp Definition

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Open Enrollment How To Choose The Best Health Insurance Plan

2021 Year Planner Hra Consulting Photo Yearly Planner Calendar Examples Planner

What Is Usual Customary And Reasonable Ucr

Flexible Spending Account Contribution Limits For 2022 Goodrx

Sea Bond Secure Denture Adhesive Seals Original Uppers Zinc Free All Day In 2022 Denture Adhesive Denture Adhesive

Best Health Insurance Companies 2022 Top Ten Reviews

Healthcare Fsa Vs Hsa Understanding The Differences Forbes Advisor

Health Spending Account Hsa Coverage List Of Eligible Expenses Groupenroll Ca

Health Spending Account Hsa Coverage List Of Eligible Expenses Groupenroll Ca

Year End Health Care Fsa Reminders Hub

:max_bytes(150000):strip_icc()/dotdash-hsa-vs-fsa-v3-66871b956baa4be786d2138777e70067.jpg)

Health Savings Vs Flexible Spending Account What S The Difference

Ebay Foot Circulation Plus Fsa Or Hsa Eligible Medic Massager Clear Foot Massager Machine Electric Muscle Stimulator Massage Machine

2022 Fsa Limit Lawley Insurance

How To Use Your Flexible Spending Account Funds At The Last Minute

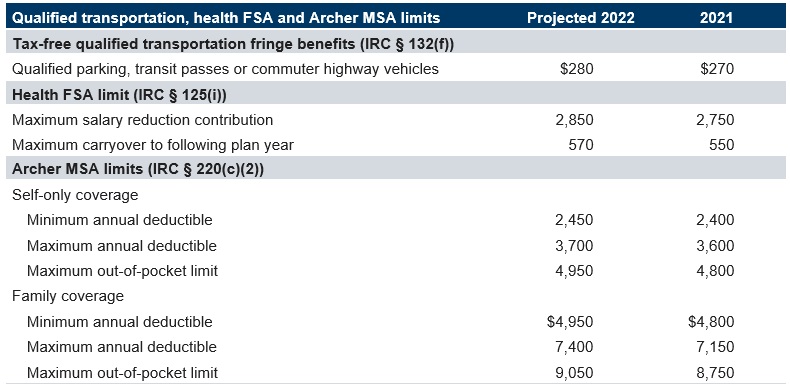

2022 Transportation Health Fsa And Archer Msa Limits Projected Mercer

2022 Limits For Fsa Commuter Benefits And More Announced Wex Inc